| 505 E. Huntland Drive, Suite 380, Austin, TX 78752-3757 |

| The mission of the Texas State Board of Public Accountancy is to protect the public by ensuring that persons issued certificates as certified public accountants possess the necessary education, skills, and capabilities and that they perform competently in the profession of public accountancy. |

Exam Candidate Information

October 10, 2025

New Pathway for CPA Exam and Certification

The Texas Legislature enacted a new pathway for applicants to qualify for the CPA Exam and obtain the CPA certificate. The new pathway includes changes to the education and experience requirements and becomes effective on August 1, 2026. The Texas State Board of Public Accountancy amended Board Rules so individuals may elect to transition from previous requirements to the new pathway. View the following resources from the Texas State Board for more information and to elect the new pathway:

New Pathway Frequently Asked Questions

CPA Exam and Certification Requirements

July 3, 2025

Notice ofSenate Bill 262

Senate Bill (SB) 262 provides a third pathway to become a Texas CPA with a baccalaureate degree and two years of experience. It was signed into law by Governor Abbott on May 8, 2025. Under the new law, effective August 1, 2026, individuals may apply to become licensed CPAs by meeting the following requirements:

- Obtain a bachelor's degree with the required coursework to include an accounting concentration

- Pass the CPA Exam

- Complete two years of relevant work experience

February 26, 2025

New Infographics

The Texas State Board of Public Accountancy created three new infographics to help candidates understand how to become a licensed CPA in Texas. Learn more

November 19, 2024

Experience, Learn, and Earn Program

The Experience, Learn, and Earn (ELE) Program, from the American Institute of CPAs and the National Association of State Boards of Accountancy (NASBA), was created to ease attainment of the final 30 hours of the education requirement for CPA licensure and allows accounting graduates unaffiliated with a participating accounting firm or employer to sign up, as long as they are employed full time. Registration for the Spring 2025 semester is open until January 1, 2025. Visit https://experiencelearnearn.org for more info. *Please note: Texas CPA certification requires 150 semester hour credits that include at least 27 hours of upper-level accounting, two semester hours of Board-approved accounting/tax research and analysis, and a Board-approved three-semester hour course in accounting. All courses must be upper-level and not repetitive of courses previously completed. Please contact the Texas State Board to confirm ELE courses are accepted by the Board before enrolling in courses.

October 10, 2024

Examination Fee Financial Aid Program

The Texas State Board of Public Accountancy launched an Examination Fee Financial Aid Program (EFFA) to assist Texas applicants who took and passed the first section of the CPA Exam after October 10, 2024, and may have a financial need to pay for additional CPA Exams. Learn more

April 5, 2024

TSBPA Customer Service Survey

Every other year, Texas agencies are required to deliver their strategic plans to our statewide elected officials. TSBPA is currently developing our 2025-2029 Strategic Plan, which includes a survey to poll our customers on how we are doing and where we need improvement.

TSBPA's Customer Satisfaction Survey will close at 5:00 p.m. on Wednesday, May 8th. Thesurvey takes 5-10 minutes to complete, and your responses are anonymous.

January 19, 2024

Requirements to Take the Exam and Additional Education Requirements for CPA Certification

Effective September 1, 2023, the Texas Public Accountancy Act has been amended. It permits candidates with a baccalaureate or higher degree recognized by the Board and 120 semester hours of Board-recognized courses, including no fewer than 24 semester hours of accounting, of which 21 must be upper-level accounting, to take the CPA Exam. In addition to the accounting courses required, 24 semester hours of business coursework is also required. Please note that candidates are still required to have 150 semester hours of Board-recognized courses, six additional semester credit hours of upper-level accounting, and completion of a three-semester hour, Board-approved ethics course in order to become a certified public accountant. More Info

October 13, 2023

Applicant Reassessment Program

The Texas State Board of Public Accountancy launched an Applicant Reassessment Program (ARP) to assist individuals who were taking the CPA Exam and through an extreme hardship occurrence, lost CPA Exam credits and may wish to pursue the CPA designation again. Learn More

August 18, 2023

NASBA Gateway System Unavailable August 25th – 28th

Please note the NASBA Gateway System will be unavailable Friday, August 25, 2023 to Monday, August 28, 2023. You will not have access to your NASBA CPA Portal account during this time.

The Gateway System will be completely unavailable and neither NASBA nor the Texas Board will have access to your NTS information.

If you are scheduled to take the CPA Exam during this time, please print or download your Notice to Schedule (NTS) form before the scheduled outage. If you do not have an NTS form, you will not be able to take the test. The system will be back online Tuesday, August 29, 2023.

NASBA's system will be down in preparation for CPA Evolution. We appreciate your patience and understanding during this transition. Please contact the NASBA Examinations Team with any questions or concerns: ?cpaexam@nasba.org

August 17, 2023

Important CPA Exam Dates and Deadlines

Please take note of the following important CPA Exam dates and deadlines. You may want to mark your calendars with these dates, as they pertain to the current and new exam.

- August 31, 2023 – Last day to accept the Application of Intent (AOI) under the education requirements of the Public Accountancy Act of 2019. More Info

- September 1, 2023 – Effective date of the Public Accountancy Act of 2023 that includes the new education requirements. First day to accept AOIs under the new education requirements. More Info

- September 17, 2023 – Eligibility applications received on this day will have 90 days of eligibility to test.

- September 18 through November 13, 2023 – Eligibility Applications received will have less than 90 days to test.

- November 13, 2023 –Last day for Board approval of Eligibility Applications for BEC.

- November 22, 2023 – First day to apply for the new Discipline sections – BAR, ISC, TCP.

- December 15, 2023 – Last day to take a section of the current CPA Exam – AUD, BEC, FAR, REG.

August 15, 2023

Effective 9/1/23: Take the Exam with 120 Hours

Effective September 1, 2023, the Texas Public Accountancy Act has been amended. It permits candidates with a baccalaureate or higher degree recognized by the Board and 120 semester hours of Board recognized courses, including no fewer than 24 semester hours of accounting, of which 21 must be upper level accounting, to take the CPA Exam. Please note that candidates are still required to have 150 semester hours of Board-recognized courses, six additional semester credit hours of upper-level accounting, and completion of a three-semester hour, Board-approved ethics course in order to become a certified public accountant. More Info

May 22, 2023

Scholarship Program Expanded

The Texas State Board of Public Accountancy (TSBPA) is pleased to announce thatHB-2217 was approved by the Texas Legislature. The Texas State Board initiated this legislation, which expands the scholarship for fifth-year accounting students to all Texas accounting students who have completed 15 semester hours of upper-level accounting coursework. The scholarship application and more information will be available on our website (tsbpa.texas.gov) under the "Scholarship" tab. A special thanks to Representative Angie Button and Senator Charles Perry for sponsoring this legislation. The effective date is to be determined.

May 1, 2023

Board Considers Extending Exam Credit to 30 Months

The Texas State Board of Public Accountancy will be considering rule amendments to increase the length of conditional credit for Texas CPA Exam candidates from 18 months to 30 months. This would allow candidates 30 months from the date of passing the first section of the exam to complete the remaining three sections without losing credit. The rule amendments will be considered by the Board's Qualifications and Rules committees. In accordance with the Texas Administrative Procedures Act, which requires Board adoption and public comment periods, the earliest this change could go into effect would be early October 2023.

The National Association of State Boards of Accountancy recently adopted amendments to the Uniform Accountancy Act (UAA) Model Rules which increase the length of conditional credit from 18 months to 30 months. The UAA Model Rules have no immediate effect on state Board rules but are provided as recommendations to encourage uniform adoption among states. Texas candidates remain under existing Board rules until the Texas Board adopts rule amendments.

April 11, 2023

Updated Prometric Water Policy

Effective May 1, 2023, Prometric will allow candidates to bring water into the test room during their exam. No other beverages are permitted. All water must be in a clear or transparent container with a lid or cap. All labels must be removed, and the container will be inspected for notes or other test aids during the security check. The candidate will need to remove the lid/cap for visual inspection by the Test Center staff. Should the container not meet the requirements outlined, the candidate will be required to put it in their locker and will not be allowed to take it into the test room.

Should a candidate require a non-water beverage during the exam, that still needs to be approved as a testing accommodation and added to the candidate's NTS, but a separate testing room will no longer be required. More Info Please contact NASBA with questions (aherjeczki@nasba.org, 615-312-3780)..

January 06, 2023

Non-Disclosure Agreement

Effective January 4, 2023, the AICPA will require acceptance of a Uniform CPA Examination Conduct and Non-Disclosure Agreement as part of the exam scheduling process through Prometric. This agreement outlines a code of conduct for maintaining the secrecy and confidentiality of the exam content. A link to the full text of the Uniform CPA Examination Conduct and Non-Disclosure Agreement is availablehere. It is important to understand your legal obligations before you take the exam.

December 28, 2022

CPA Evolution: Key Tentative Dates Announced

The CPA Exam ischanging significantly in January 2024. Tentative application information and testing schedules for late 2023 and tentative testing and score release schedules for 2024 have been announced. If you pass and retain credit for all four CPA Exam sections by December 31, 2023, the changes to the CPA Exam and its future administration will NOT impact your status. If you will still be working your way through the CPA Exam in January 2024 and beyond, then the information about the CPA Evolution-aligned CPA Exam (the 2024 Exam) and its administration are most important to understand.

Important 2023 Administration Dates

Candidates should note that the last day of testing for all current CPA Exam sections (AUD, BEC, FAR, and REG) is December 15, 2023. No CPA Exam sections may be scheduled from December 16, 2023, through January 9, 2024, to allow for conversion of IT systems to the 2024 CPA Exam sections. Candidates are encouraged to plan their testing schedules accordingly.

Candidates wishing to take BEC in the latter part of 2023 need to know that the Eligibility Application should be submitted to the Board no later than September 17, 2023 so that you have time to pay the exam fee to NASBA, schedule your exam with Prometric, and take the exam before December 15, 2023, which is the last day for testing in the current CPA Exam format. Please understand that Texas has a 90-day eligibility period, and you will not have the full 90 days if you submit the Eligibility Application for BEC after September 17, 2023.

Candidates applying for a discipline section – Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP): Authorizations to Test and Notices to Schedule for BAR, ISC, and TCP may submit the Eligibility Application to the Board after November 22, 2023.

Eligibility Applications for AUD, FAR, and REG may be continually submitted and processed at any time for the core sections that will start in 2024; however, the scheduled blackout days do apply.

The Board will take into consideration the blackout days beginning in 2024 when calculating your 90-day eligibility period for AUD, FAR, and REG and for the new disciplines – BAR, ISC, and TCP.

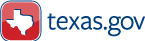

Important 2024 Administration Dates

Please note that these dates are tentative pending further review by AICPA:

Testing is expected to begin on January 10, 2024, for all sections. While the core sections (AUD, FAR, and REG) will first be available for testing through March 26, 2024, the discipline sections (BAR, ISC, and TCP) will be available for testing through February 6, 2024. Scores are expected to be released only once per test section, per quarter, due to necessary standard-setting analyses and activities. Please refer to the above timeline for test date availability for the remainder of 2024.

Credit Extension and Transition Policy

Due to the limited testing schedule and delayed score releases in 2024, the Board will allow candidates with Uniform CPA Examination credit(s) on January 1, 2024, to have the credit(s) extended to June 30, 2025.

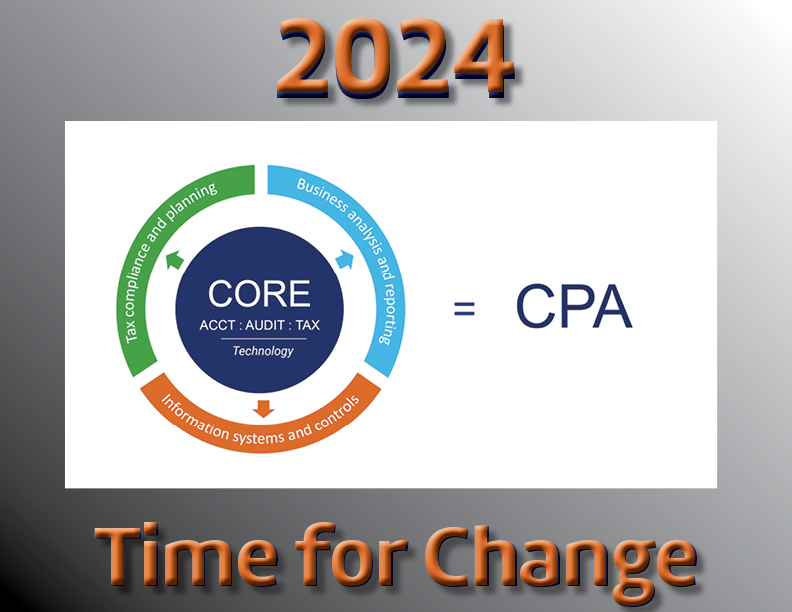

The new CPA licensure and CPA Exam model is a Core and Discipline model. The Board recognizes and maps thetransition policy for CPA Exam sections passed under the current CPA Exam to credit under the 2024 CPA Exam. Candidates who will start taking the CPA Exam in 2023 but continue to take sections in 2024 should review this policy.

Read more.

April 25, 2022

CPA Exam Infrastructure and Content Changes Planned for January 2024

The American Institute of Certified Public Accountants (AICPA) is planning to roll out CPA Exam infrastructure and content changes with the new CPA Exam scheduled to launch January 2024. These changes are expected to reduce complexity in constructing the CPA Exam and improve the CPA Exam software performance for candidates. By delaying these changes until 2024, the AICPA hopes to minimize disruptions and score release delays for candidates.

The following infrastructure and content changes are planned for January 2024:

Another significant change is that the four CPA Exam Sample Tests (one for each CPA Exam section) will be merged into a single Sample Test. This change will occur between July and October 2023.

For an in-depth description of each of these changes,read more.

March 31, 2022

CPA Evolution Transition Policy: What You Need to Know

As you may have heard, the Uniform CPA Exam is changing significantly in January 2024. The new CPA Exam consists of a new core + disciplines. It will continue to provide a strong foundation in accounting, auditing, and tax while adding increased emphasis in technology. All sections of the new Exam will test on technology knowledge and skills. CPA candidates will also test in their choice of one of the three new discipline sections, which are 1.) business reporting and analysis, 2.) information systems and controls, and 3.) tax compliance and planning.

- If you successfully pass AUD, BEC, FAR and REG and retain credit for each before December 31, 2023, you do not need to test under the new 2024 CPA Exam. You must simply meet the other requirements for licensure and apply for your CPA license. If you have credit for BEC on the current CPA Exam, you will not need to take any of the three new discipline sections.

- If you lose credit for AUD, FAR, or REG after December 31, 2023, you must take the corresponding new Core section of AUD, FAR, or REG. If you lose credit for BEC after December 31, 2023, you must select one of the three new discipline sections.

The proposed 2024 CPA Exam blueprints and test design will be published on July 1, 2022, and the finalized Core and Discipline blueprints along with the test design will be published in January 2023. None of the sections of the current CPA Exam will be available for testing after December 31, 2023.

For more information visit EvolutionofCPA.org and read theFAQ. Email questions to Feedback@EvolutionofCPA.org

August 17, 2021

Prometric Continues Mask Mandate

Prometric continues to require everyone appearing at a Prometric testing center to wear masks for the foreseeable future. According to Prometric, this decision was made based on recent updated guidance and data from the U.S. Centers for Disease Control and Prevention (CDC) and World Health Organization (WHO). The only exception to the mask mandate rule at this time will be at sites on state universities where executive orders prohibit government agencies and institutions of higher education from mandating face coverings or restricting activities on their respective properties in response to the COVID-19 pandemic. Candidates will still be allowed to wear masks according to their comfort level at these sites, but masks will not be mandatory.

Prometric also announced it will resume metal detector wanding candidates prior to entering the test room, frequent physical walkthroughs of the test room, and the use of erasable note boards and markers. The resumption of these various touchpoint processes was based on Prometric's engagements with John Hopkins University and data from the CDC and WHO, which demonstrates COVID-19 transmission via touch is exceptionally rare.

Starting September 1, 2021, Prometric will no longer accept IDs that are more than 90 days expired. Prometric will continue to accept IDs that have expired within 90 days of the exam date for the interim.

Visit Prometric's Website

for more information.

August 25, 2020

• We've Moved!

to 505 E. Huntland Drive, Suite 380 Austin, TX 78752

–

Contact Information

July 27, 2020

• Board Eliminates In-Person Class Requirements

An amendment to Board Rule 511.57 allows Texas CPA Exam applicants to take the 30 semester hours of upper level accounting in any format established by the university and has eliminated the required 15 hours of face-to-face accounting courses. More info about requirements for examination

May 1, 2020

• New CPA Exam Testing FAQs

Read NASBA's new CPA Exam Testing FAQs

January 30, 2020

NASBA: International Candidates to Test in Europe

On February 1, 2020, all CPA Examination candidates (international and domestic) will now be able to test in Europe in the same manner as they would test in the United States.

September 18, 2019

Review and Update Your Contact Information

To ensure you receive important Board communications, use Online Services to quickly and easily review and change your contact information.

December 19, 2018

Tax law changes eligible for REG testing

Information is available regarding the "Tax Cuts and Jobs Act".

May 23, 2018

Panel Discussion: Future Skills and the MRA

NASBA and other accountancy bodies around the world share a panel discussion about the status of mutual recognition agreements and future skills that accounting professionals will need.

February 2, 2018

CPA Exam - Tax Law Integration

AICPA has published information on exam content related to the "Tax Cuts and Jobs Act."

Online Services

|

Follow us

Follow us