Agency Overview

The Texas State Board of Public Accountancy (Board) operates pursuant to the authority of Chapter 901 of the Texas Occupations Code, short titled the Public Accountancy Act (Act). As provided in the Act, the terms “accountant” and “auditor” and any derivations of those terms imply competence in the practice of public accountancy. The public relies on that implication of competence when it employs a certified public accountant (CPA). The Board, in order to protect the public and ensure competence in the practice by the profession, examines, certifies and licenses CPAs and restricts the use of these terms to its licensees.

The Public Accountancy Act provides for 15 Board members appointed by the Governor, with the advice and consent of the Senate, for six-year staggered terms. Board members are required to be citizens of the United States and residents of Texas. Board membership is structured in the following manner:

8 must be licensed CPAs who are in public practice at the time of their appointments to the Board;

2 must be other licensed CPAs who may or may not be in public practice at the time of their appointments to the Board; and

5 must be public members who are not licensed under the Act and who are not financially involved in an organization subject to regulation by the Board.

Agency Mission

The mission of the Board is to protect the public by ensuring that persons issued certificates as CPAs possess competency and integrity in the practice of public accountancy.

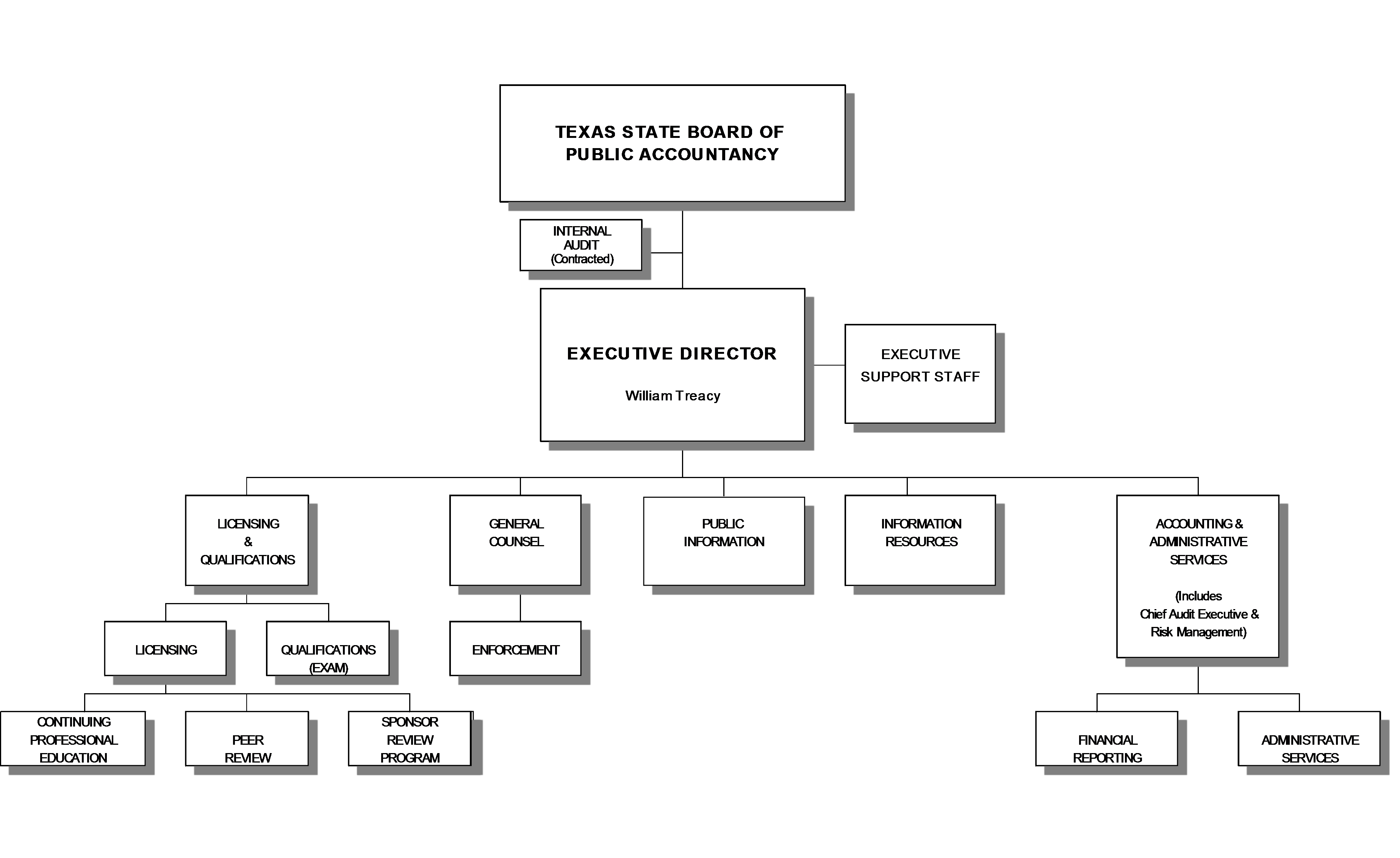

Organization Chart

The executive director reports directly to the Board and manages the activities of the various divisions. The agency utilizes management by objectives, allocating resources to those tasks deemed highest in priority to ensure that objectives are met in a timely and efficient manner.